I suppose Tilt is a superb savings app that stands out for its ease of use and considerate options. Feedback from others has also highlighted how enjoyable and encouraging the app is in comparability with more rigid financial tools. We like how simple it’s to create a number of jars and watch the progress construct visually within the app. Transfers back to a bank account are usually fast, and the AutoSave rules are easy to toggle on or off. It feels like a digital improve to money envelopes, except you don’t earn any interest in your financial savings. Bankrate.com is an unbiased, advertising-supported publisher and comparison service.

After the negotiation is completed, you’ll getan e mail telling you ways a lot money the negotiators have been capable of save for you. Acorns’ Found Money characteristic is included with all plans, and includes a chrome browser extension. After all, with all of the speak of social safety potentially turning into out of date in a few years… it’s really in our own arms to plan for our “golden years”.

There are a lot of different ways that these apps can do that, however the commonest method is by helping you arrange a price range and observe your spending. To show you ways serious they are by means of tracking, they will sync to 1000’s of establishments, including checking and financial savings accounts, credit cards, and mortgage and private loans. In today’s digital-first economic system, managing private funds has turn out to be more accessible than ever.

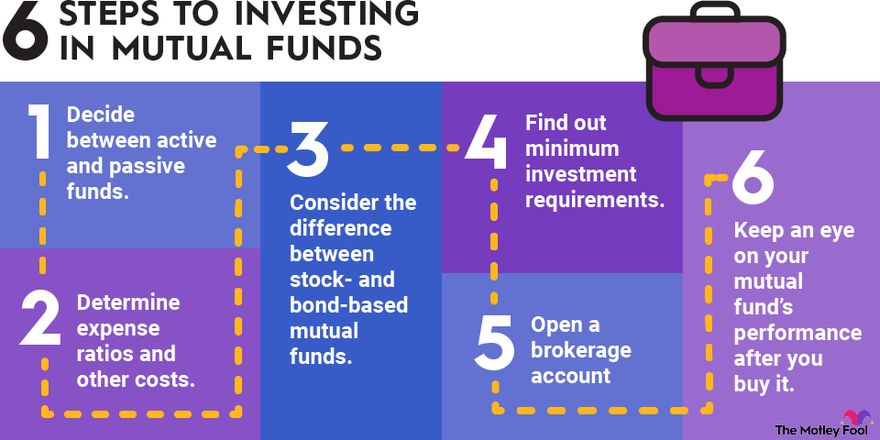

These apps make micro-investing as easy as sticking to an automated financial savings plan and assessing your risk comfort stage. And they allow you to start with small balances, so that you don’t have much to lose. We looked at apps that provide money-saving with you in thoughts, contemplating fees, features and techniques that we need to use and determine individuals looking to save would as nicely. Checking and savings are linked; everytime you make a purchase along with your checking account, Chime rounds up to the nearest dollar and adds the distinction to financial savings. Or you can have Chime auto-deposit 10% of each paycheck into savings before the remaining hits checking. The Krazy Coupon Lady clues you in on offers and rebates out of your favorite retailers and types.

You can both clip coupons for in-store use or link them to your store loyalty card for automatic financial savings. Jumia Food is one other grocery saving app that lets you order meals and groceries from local stores and have them delivered straight to your door. Whether you’re exhausted from cooking back-to-back meals or stocking up on essentials, this app for saving money on groceries will definitely come via for you. It makes it easy to buy from your telephone and have it all delivered very quickly. It’s simple to really feel like your paycheck disappears into your cart, especially whenever you don’t have an app for saving money on groceries.

We gather data from one of the best out there sources, together with vendor and retailer listings in addition to different relevant and impartial evaluations websites. And we pore over customer reviews to seek out out what issues to real people who already own and use the services we’re assessing. The credit card offers that appear on this site are from companies from which FinanceBuzz receives compensation such as banks or CardRatings.com. FinanceBuzz doesn’t embrace all financial or credit offers that could be obtainable to customers nor do we include all corporations or all obtainable merchandise. Information, including rates and costs, is accurate as of the publishing date and has not been provided or endorsed by the advertiser.

Let’s take a look at the top 15 apps I have personally used to help make some further room in my grocery finances. The Entertainer helps moms who love scoring offers on groceries and revel in eating or purchasing perks on the side. If you’re at all times seeking to stretch your price range with out compromising on quality, The Entertainer is a unbelievable choose. As a busy mum myself, this is a great choice if you love the thought of incomes cashback on grocery items with none further effort. It’s additionally nice for you if you shop a lot (or have lots of mouths to feed), since the more you purchase, the extra you save. But whether or not you are concerned about your finances, or simply want to develop your internet worth and portfolio, there are apps on the market that may help you succeed.

This means you can divvy up significant deposits in a number of taps to make positive you cover your commitments whereas still saving. And if you want more options further help or wish to prioritize their financial well-being there’s Cleo Plus, for just 5.99 a month. And it was only a matter of time earlier than the fintech world would use this to assist individuals with their finances.

Whether that is groceries, garments, or simply seeking to deal with yourself sometimes. And these savings apps can automate a variety of the financial work for you. Yet, saving money with apps has turn out to be so in style that there’s a sea of choices proper at your fingertips. It can be a bit overwhelming to know which ones are stable options and are trusted. These are another popular money-saving apps that also work with the round-up methodology to save lots of you’re probably conversant in by now. Though you can e-book a room up to one hundred days in advance and keep a couple of night time, HotelTonight presents entry to last-minute bookings.

If you desire to an extra place to store money for a common goal, like a holiday price range or a pair’s trip. Investopedia was founded in 1999 and has been serving to readers find one of the best finances apps since 2020. Investopedia’s research and editorial teams conducted independent analysis into price range apps to offer readers the best recommendations for a wide variety of circumstances. Investopedia researched and evaluated ten in style price range apps throughout 28 criteria, collecting and calculating 280 data factors to find out the best picks above.

Additionally, if you select to fund the account via Direct Deposit from your employer, Chime will let you receive your paycheck as a lot as two days sooner than your co-workers. Instead of consumers paying a set account upkeep payment, they “tip” as much or as little as they want for Aspiration Bank’s companies. And inside every category… you’ve the flexibility to make notes, track transactions or convert it right into a fund.

It makes discovering the best worth on your subsequent hotel keep much simpler. Paying off your loans sooner saves you so much money on curiosity, so this really is an effective app to consider. Also, if you want to invest your financial savings, then you can even try this with Qapital.

With customizable savings frequencies and real-time budget changes, you preserve management while steadily constructing monetary reserves. Users can successfully work towards paying off debt with dedicated Debt Accounts that visually monitor progress towards monetary freedom. Simplifi’s standout characteristic is its dynamic spending plan that automatically recalibrates your price range daily based on income fluctuations and spending habits. Nothing on this communication ought to be construed as tax advice, an offer, recommendation, or solicitation to purchase or sell any safety.

All the apps featured are free, though some have a “premium” model which is paid-for. Even when you have prescription coverage through your insurance coverage, GoodRx could provide you with prices decrease than your copays. Undebt.it is probably considered one of the most helpful instruments in case you are in search of assist paying off all your debts. In terms of budgeting, Rocket Money kinds your transactions into totally different classes, from groceries to housing and anything in between. Rebranding from Fetch Rewards to simply Fetch in 2023, this cashback app accumulates points as you upload each digital and physical receipts. As you accrue your cashback, you receives a commission every quarter as lengthy as your cashback reaches no less than $5.

And there is a low threshold to cash out, not like other cash again apps. Money-saving apps have revolutionized the greatest way people handle their finances and achieve their savings objectives. The top 14 money-saving apps highlighted in this article offer a diverse vary of options and advantages that may make budgeting and saving money extra convenient and efficient. If you’re looking to earn cash back, find nice deals, and use coupons whereas shopping, look no further than the Rakuten app. As a free app, Rakuten provides a simple way to economize on your on-line and in-store purchases. If you’re in search of a reliable app to track your expenses and acquire valuable insights into your spending habits, look no further than Rocket Money.

The presents that appear on this web site are from companies that compensate us. But this compensation does not influence the data we publish, or the reviews that you see on this site. We don’t include the universe of corporations or financial presents that might be available to you.

Instead of excited about saving giant sums without delay, you must use these apps to often move smaller quantities into financial savings, making it easier to achieve your financial targets. Chime is a well-liked digital-only monetary model that has garnered tens of millions of customers with its auto-savings tools and aggressive rates of interest. When you open a Chime account, you presumably can enable options corresponding to computerized savings transfers, which transfer a percentage of your paycheck directly into savings each time you get paid.

Trim has each a free and paid version pending what features you’d want to reap the advantages of specifically. Don’t rely on reminiscence alone to find close by AARP member reductions. The listing of benefits, your digital membership card and the ability to renew your membership are all the time in your pocket or purse with the AARP Now app.

And lastly however equally as important, AccuWeather is a free app that helps vacationers keep away from weather-related bills by plan more efficiently for the elements. “It connects users with local cafes, eating places and bakeries providing surplus food at lowered costs,” he defined. Perfect for experiencing native cuisine without spending your complete budget. With the Smart Stash feature, Stash will mechanically switch some cash from your funding account to your Stash Individual Account, relying in your spending patterns.

Built as a neobank, Jupiter focuses on delivering a monetary experience that keeps pace with modern users’ wants. It even contains an computerized savings device to automatically switch money to your savings account, tracking alerts, linking to your other external bank accounts. Piecework works by analyzing your revenue, spending, and student loans. The 15 money saving apps below will permit you to discover the cheapest gas in town, allow you to earn cash again rewards on gas purchases, and help you discover the quickest routes to your destination. Receipt Hog is a rewards and cashback app for saving cash on groceries that lets you earn cash by snapping photographs of your receipts.

As you join Trim, you will need to hyperlink it to your bank account and credit card accounts. Other services, such as Snoop, analyse your bills and counsel cheaper offers for household payments, similar to broadband and power, which may assist you to lower your expenses. You can even use a cash saving app to construct up a wet day fund to cowl emergency bills.

The fund provides a variable annual return (VAR) of up to 3.95% on its Max plan, three.76% on its Boost plan, three.48% on its Plus plan and 3.02% for its Basic plan. First, we provide paid placements to advertisers to present their presents. The payments we receive for these placements impacts how and the place advertisers’ provides appear on the site. This web site doesn’t include all corporations or products out there within the market. By utilizing Qapital, you can set targets and rules that the app will guarantee to help you save and invest better.

Rising housing costs are a major roadblock to saving money in Florida. When a important portion of your income goes towards housing prices, it could be extremely difficult to save cash, especially when costs on everyday goods are additionally elevated. We like that YNAB offers a goal-tracking characteristic designed to assist people turn out to be more intentional about where their money goes every month. Users can set customized financial savings targets, and YNAB will calculate how much they should save—each week, month, 12 months or by a particular date—to attain their objective. YNAB even sends reminders of how a lot money you must be adding to a category to stay on observe together with your set aim. The Rocket Money app is available on both Android (4.6 stars) and iOS (4.5 stars).

PocketGuard is value trying when you don’t want to spend a lot on a finances app, especially if you’ll go for the yearly subscription. The free model has fundamental features and may be suitable for some people, although you’ll be restricted in the variety of accounts you can sync and the number of budget classes you possibly can create. For a comparatively small charge you probably can improve to PocketGuard Plus, which lets you sync as many accounts and create as many finances classes as needed. You’ll also get access to subscription value negotiation, which will routinely attempt to cut back your payments for companies like web and cellphone plans.

It can even assist you to to make use of the best card to pay for providers like web, telephone, and cable TV. There are additionally some with a free model however have very limited features, urging you to go for the premium plans instead. Note, although, that the effectiveness of the apps may also be primarily based on how well you reply to their suggestions and suggestions. Some monetary advisors even use these apps themselves and advocate them to their clients.

Automatic expense tracking is another space the place this software program really shines as a end result of it’s so correct. You may even fine-tune the rules used to categorize your purchases and add tags to batch transactions purchases collectively, corresponding to travel prices for an upcoming trip. If you’re particularly in search of a approach to save for targets, it may profit you to get a financial savings account with buckets. Buckets are customizable instruments that separate your financial savings so you can save for specific targets. Since they are an built-in checking account function, additionally they may be easier to manage than a budgeting app.

In this text, I’ll introduce you to the 14 finest cash saving apps of 2025. These apps usually are not only free but in addition provide a selection of features designed that will help you get financial savings on everything from groceries to budgeting. Ibotta provides cash-back opportunities with hundreds of prime brands and retailers, including Best Buy, Safeway, eBay, and far more. It’s completely free to make use of, and you’ll get an immediate $20 bonus credit just for signing up. Also, it’s straightforward to switch your cash-back rewards from Ibotta directly to a present card, checking account, or PayPal account. It starts together with your earnings, subtracts payments, subscriptions, and savings objectives, and shows you what’s left to spend.

Digit will determine when you can withdraw cash into your savings or wait until you’re in a greater financial place. You also can arrange automations to maneuver money into your financial savings account and activate balance and spending notifications. Mint breaks down your spending per category so yow will discover opportunities to save. It also notifies you of upcoming payments and any will increase in subscription prices so that you never miss a factor. The finest cash saving apps make building your nest egg easy – all you need is a smartphone. Saving money is essentially the most difficult in California, with roughly 38% of residents having hassle affording basic bills.

When choosing whether or not an app is value downloading, ensure you weigh the costs versus the advantages. In some instances, a small monthly subscription cost will eat into the savings the app provides, or even go away you with a web adverse. EveryDollar is a straightforward budgeting app from Dave Ramsey that makes use of the zero-dollar budgeting principle to assist control overspending and pay off debt.

Trolley compares prices at sixteen major supermarkets, including Aldi, Asda, Waitrose, Morrisons, Co-op, Tesco and Sainsbury’s, and allows users to examine on over 200,000 objects. With Superdrug and Boots additionally included, it can save you on the value of a number of magnificence products as well. A digital wallet for loyalty cards is a very simple thought – and what customers love about SuperCards is that they haven’t attempted to gild the lily. There’s no sign-up required, no need to log in, no particular offers or bonus points, no adverts, no articles, no premium membership schemes, no data mining, only a actually easy-to-use, handy app. So, to avoid wasting you not just cash, however time as properly, listed here are ten of the most effective apps that will help you spend less on everything from grocery store retailers to petrol, clothes to telephone bills. From money back on your shopping to cut-price meals, find out that are the most effective apps to save tons of you cash.

You can construct a customized budget that tracks your spending and gives steps to reach your monetary objectives. There are games and quizzes which help your monetary literacy, plus you’ll find a way to probably win some cash. Not solely do they help you save money, but assist you to get began with investing too.

This allows the app to track your spending, savings, and different financial transactions precisely. By syncing your accounts, you may get a comprehensive view of your monetary well being and make informed choices about your cash. Every time you make a purchase by way of the app, you’ll earn a share of money back. Plus, Rakuten frequently presents exclusive deals and coupons, allowing you to maximise your savings even more. By automating your savings with Rocket Money, you’ll be succesful of consistently develop your savings with out the trouble of guide transfers. Whether you’re saving for a vacation, a down cost on a home, or an emergency fund, Rocket Money’s budgeting instruments and automated savings options will keep you on track.

You can use the coupons instead of insurance or Medicare Part D but not together. Through the app, yow will discover stores and restaurants that place surplus meals in “Surprise Bags” you buy for lower than the meals in any other case would cost. You can listing dietary necessities similar to vegan or vegetarian if you arrange the app.

It’s pretty cool how Oportun works quietly within the background as you go about your life. It shifts cash in small, painless amounts and makes it easy to maintain a quantity of targets moving without delay. The surprise issue, realizing you’ve saved with out noticing, is motivating, and the $5 per 30 days charge might be worth it should you battle to save persistently.

Then, for money-saving, I counsel putting in the Rakuten Chrome Extension which operates anytime you’re buying something online. I purchase 95% of stuff for myself and our household online, and I get about $2-300 dollars back with Ebates/Rakuten every year. The content material on Young and the Invested is for informational and academic purposes only and shouldn’t be construed as skilled monetary recommendation. Should you want such recommendation, consult a licensed monetary or tax advisor.

One method of making it cheaper is to hunt out the very best current offers, which is where the price comparison app Trolley can help. There are many voucher apps and websites, however VoucherCodes is amongst the best and most established, saving customers an estimated £62 million last year. Olio has now expanded its remit to incorporate home items (similar to apps such as Freecycle).

If you and your partner try to get on the same web page about cash, apps designed for couples like Honeydue and Monarch Money may be just right for you. For people who wish to keep tight control over their spending, zero-based budgeting apps like YNAB and EveryDollar are price contemplating. They assist you to determine tips on how to spend every dollar you earn prematurely, serving to you create a strict sport plan in your money. People who prefer a flexible app that works with any budgeting fashion will enjoy Lunch Money, our top choose.

Ibotta is partnered up with many various retailers permitting you to economize on many different in-person and on-line shops. While not everyone’s grocery bills are going to be the identical, there are methods for you to get financial savings whether you’re a single pupil in college or a stay at residence mother of three. Apps like Kroger let you monitor your grocery list and complete prices, helping you persist with your price range while purchasing. For instance, I use a cashback app like Ibotta alongside a coupon app like Coupons.com.

However, the additional apps that made our rating are price contemplating if you wish to increase your savings objectives this year. There’s a lot you can do with these cellular apps to work on reaching your financial goals, whether or not they’re building a safety internet, reducing expenses, or even buying a home. Simple steps can lead to massive financial savings in the long term, and apps like these make doing so easy.

You’ll upload a duplicate of your invoice, and Rocket Money will determine whether or not you will get the identical service with the company for a lower price. Rocket Money can also assist you to get refunds should you’re charged financial institution overdraft fees or late fees. You can chat with your associate inside the app, and simply send one another notifications about accounts, balances, or specific transactions. If you pay for one thing together, you can cut up the expense to specify how a lot every of you paid. It has a wide selection of unique options designed for that objective, making it easier to remain organized and conscious of what’s up along with your partner’s financial scenario. One spotlight of PocketGuard is the flexibility to split transactions into a quantity of classes.

You can learn more about our editorial pointers and the banking methodology for the scores under. FinanceBuzz writers and editors rating merchandise and companies on numerous objective options in addition to our expert editorial evaluation. Undebt.it says users are paying off $9 billion in debt using the service. It’s a great app for newbies, however you might contemplate upgrading to another service for bigger investments down the highway. With qualifying direct deposits, pods can earn up to 4.00% annually (0.25% if not).

Each of those apps offers a definite approach to the age-old challenge of saving—whether via automation, AI-driven insights, or behavioral psychology. Like a financial compass in your pocket, they navigate the advanced waters of private finance, guiding you towards your goals with strategic precision whilst you barely raise a finger. Twine stands out as another app that is wonderful for couples who’re saving toward a shared goal. Here’s how it works, decide a aim, like saving for a marriage, a house, retirement, and so on., join your bank accounts, and begin saving. Twine allows you to observe your progress, and the app can offer you customized suggestions that can assist you to reach your monetary objectives. It also provides bank-level security to make sure that your delicate monetary data is saved private.

Lunch Money presents a $10 monthly cost possibility, as properly as an annual “set your personal price” option that ranges from $50 to $150. Lunch Money is a web-first app, that means it’s optimized for a laptop computer or desktop laptop. The Lunch Money app is on the market on both Android (4.5 stars) and iOS (4.4 stars), though there are only a few rankings. We like that Wallet makes it easy for customers to investigate their money move and spot areas that need enchancment. Wallet mechanically categorizes your spending, identifies recurring payments and exhibits you your expected web money balances that will assist you plan forward.

Other financial savings apps give attention to other priorities, like getting deals or rewards if you spend. Monarch Money is one of the best budgeting apps for maintaining monitor of what you spend and where you spend it. With this app, you’ll have the ability to customize a budget utilizing the zero-based budgeting technique with personalized spending categories, getting as specific about your spending as you want to get. Then, you link your checking account to the app and it routinely tracks and categorizes your transactions for you. It’ll inform you whether or not you’re on target together with your budgeting limits and precisely how a lot you’ve left to spend in each of your classes. Chime is one other free money-saving app that includes different banking companies, including checking and financial savings accounts.

This app finds the most effective last-minute hotel offers in some of the most popular cities to let you get the most effective worth attainable in your keep. However, there are times where you simply need to get a hotel rapidly and don’t need to pay an excessive amount of for it. With automotive sharing apps reaching an all time high over the previous few years, it’s no shock that we are seeing increasingly apps pop up with the identical premise. This app is very simple to make use of and can help you find the most effective costs on just about any sort of journey and any measurement party. That is exactly what Service, a travel savings smartphone app, can do for you.

Plus, you can even use Groupon Goods to get low costs and get up to 30% cashback at taking part Groupon eating places. With the app, you presumably can redeem offers instantly out of your mobile gadget, and get promo codes, and special savings alerts for deals close to you. Skype is amongst the best apps out there for making free voice and video calls. In truth, you can take part immediately messaging group chat with up to 300 people.

Before you think these apps are too good to be true and start doubting them, let me share with you the way they work. If you’re saving for a deposit in your first house you may be prone to have a bigger money balance, albeit a quick lived one. To help help our reporting work, and to continue our capacity to offer this content free of charge to our readers, we receive cost from the businesses that advertise on the Forbes Advisor site.

Get the newest information on investing, money, and extra with our free e-newsletter. Investing is a great method to earn interest on cash that you simply won’t need within the short time period. You can download the app in your phone and get a free stock to get started.

This is much like most budgeting apps and tracks all of your spending and earnings and creates stories to swimsuit your targets. SavvySave is a value comparison and savings app that helps you find the most effective deals on groceries and home items. It scans prices from numerous stores and highlights the place it can save you the most.

When you share banking credentials with a good private finance app, like those on this listing, you’re giving the app “read-only” entry. With this sort of access, you’re giving them permission to see your activity, but to not make any adjustments.Furthermore, reputable financial apps don’t store your knowledge inside of the app itself. So, if someone have been to steal your telephone and achieve access to the app, they wouldn’t have entry to your login information.

If you’ve a good price range, it may look like it’s unimaginable to save money, but a savings app is one of many proven ways to save heaps of. Money-saving apps use the power of your smartphone to make it easier for you to save money. How a lot power you need to hand over to your money-saving app is as a lot as you. These apps range from helping you make investments for retirement to putting funds apart on a tight budget to saving for a selected short- or long-term objective.

In addition to serving to simplify your financial life and transcend basic budgeting, Albert presents benefits that can assist you earn and get monetary savings. It also provides spend-tracking options, budgeting tools, automated saving options, net worth insights and even invoice negotiation providers. With bill negotiation, Rocket Money will attempt to get you refunded for charges and find reductions in your present payments.

You can even arrange and monitor Direct Debits, set budgeting objectives and monitor your progress. Bear in mind that these pots, unlike a conventional financial savings account, don’t pay interest on balances. You can use their mobile apps to connect all of your accounts in a single place, which helps you retain observe of spending and web value. You can join things like banking accounts, bank cards, and investments as nicely.

There’s also a special promotion obtainable right now — 50% off of first year subscription (offer ends May 31, 2025). Investopedia’s full-time compliance group maintains the knowledge on this page to ensure the content remains accurate and our suggestions are the finest possible options obtainable. You could find that breaking down your bills into these categories gives you an easier however more effective method to understand your financial habits. Facebook Marketplace allows community members to buy, sell, give, and commerce items.

Not with SuperCards – a digital pockets that stores all your loyalty playing cards in a single place in your phone, so they’re only a faucet away. It’s a genius concept that benefits users and retailers, and prevents meals waste into the discount. These apps present alternatives to construct a brighter monetary future, providing tailor-made options to a variety of consumers’ wants. Stash enables you to make investments your savings in your alternative of thousands of shares and funds.

But with WiseBanyan, you’re in a place to buy a small portion of the shares, so you solely have to invest as little as $5 at a time. You needn’t worry as Trim sends common texts to let you know how your accounts are doing and any changes that have been made. Once accredited, your Chime Debit card shall be mailed out to you inside ten days. Chime Bank expenses nearly no charges to its prospects, and a half of the cause is that Chime has no brick and mortar locations, it’s strictly a web-based financial institution. We all know too properly the varied charges and costs incurred at banks.

One of the toughest issues for individuals to do with their finances is to create a finances and persist with it. Using an app such as BillTracker might help you better track your payments to ensure you are all the time paying them on time. One of probably the most overlooked bills that many individuals may not notice is paying late charges on payments. You can even kind by the sort of fuel grade you need, the space you are keen to travel, and you may kind by price to seek out which stores have the most affordable gasoline costs at that second.

With Fetch Rewards, you earn factors for scanning your grocery receipts, shopping for collaborating manufacturers, and purchasing products that provide bonus factors. There’s no want to visit particular stores, scan barcodes, or scroll by way of countless lists of merchandise to save lots of. Generally, good money-saving apps assist you the place you need assistance so you can hit your monetary objectives quicker. Undebt.it is a device that helps you set up a personalized debt-payoff plan. Once you arrange an account, you enter your debts along with how much you owe, the rate of interest, minimum cost, and due date.

Monarch is amongst the best alternate options to Mint, offering a range of budget instruments from primary to advanced. It’s also a solid choice for couples, as budgets can be shared with a partner. Our editors are committed to bringing you unbiased ratings and data. We use data-driven methodologies to evaluate monetary merchandise and companies, so all are measured equally.

Investopedia’s analysis and editorial teams examined 10 well-liked budget apps in April 2025, scoring and ranking each based on 28 criteria. Each app was evaluated based mostly on its fees, availability, options, and buyer satisfaction, among different factors. Investopedia collected 280 knowledge points to objectively rating and rank each app, ensuing in the recommendations below. Get as a lot as 3.50% savings interest on your balance and a free budgeting app. GasBuddy is your secret key to finding the most value effective gasoline costs in your space.

This cloud-based app ought to be in a position to store the receipts for your stock and future review. The app ought to have the flexibility to extract and save all of the important information from the receipt simply, like the precise expense, cost method, date, and location. As a digital or neobank, Qapital does not have any bodily shops however features like a daily financial institution. It grew to become even more in style when creator Jeff Whiten appeared on the TV collection Shark Tank. One of the identical old issues with the app is that the charges are too high and may influence low-value buyers. However, as you gain money over time, take note that your earnings may also rely upon the performance of your portfolio within the inventory market.

Additionally, PocketGuard has personal finance courses, a subscription canceling characteristic, a bill negotiation service, and analytics instruments that will help you manage your cash circulate. If you’ll quite have extra sturdy budgeting instruments, a budgeting app will likely still stand out to you. Budgeting apps additionally join funding accounts, credit cards, and loans, so you’ll see everything in a single place. Like many different financial apps, Revolut allows you to make one-time deposits or set up recurring transfers to your Savings Vault, where you retain your savings. You can add money to a Revolut account in quite a few methods, together with financial institution switch, debit card, Apple Pay or Google Pay, direct deposit, even transfers from different Revolut prospects.

Customers can then use the app to see what listings can be found in their area, from snacks to ingredients to takeaway meals, usually obtainable for round a 3rd of the unique asking value. Across a year, the TopCashback app may prevent lots of of kilos. If you’re reserving a lodge, quite than go direct to the Expedia web site, you open the app (or website), sort Expedia into the search function, click on on the link and enter that method.

Next, you will need to open the Mogl app and discover collaborating presents that can permit you to earn money again on in your city. This not solely helps you earn money back, but it also helps the restaurant or firm higher their companies and offerings to offer a greater experience for everyone. While Taco Bell is a staple for these who reside frugal since their costs are already fairly low, having this app is one other secret weapon you can use to avoid wasting even more cash. Hooch, a eating rewards app, allows you to earn up to 10% back in TAP dollars together with getting access to exclusive offers in journey, store, and eating categories. When it involves saving cash on dining out, there has all the time been one go-to app that has been a client favourite throughout the years.

Money is FDIC-insured via companion banks, and you may transfer funds out and in anytime with no penalties. On high of that, the Side Hustle characteristic connects you to surveys and more than 1,000 flexible gigs and aspect hustles so you possibly can grow your income proper from the app. Rocket Money is right for customers who wish to take management of their finances while eliminating unnecessary expenses. It can sync across a quantity of devices, allowing all household members to trace and handle the household finances collectively. The free version contains as a lot as 10 envelopes, however for $10 a month, you probably can unlock limitless envelopes and sync throughout five units.